Discover Your Retirement Number in 90 Minutes With The Math Done For You

Most people have no idea how much they need to retire. This workshop figures it out for you

Join Retirement Planning expert Rob McGregor for this live How Much Workshop - Live September 1st - 2025

Includes Interactive How Much Calculator and step-by-step Workbook, with Lifetime Access

Step 1 - Watch the Video Below

Step 2 - Read Why Your Need to Know Your Retirement Number

Most Australians have no idea if they can retire, or how much they'll need to live the lifestyle they want.

In fact, 83% don't have a retirement plan or a clear number.

They're simply hoping their super and savings will be enough or avoiding it altogether.

Without a plan, everyday of retirement is overshadowed by one fear.

Running out of money

That fear turns what should be your golden years into years of stress.

If you are planning on retiring soon, the uncertainty might already be keeping you up at night.

You could run out of money 10 years too soon and be forced to rely on the age pension.

Or, worse, you might work longer than you need to because you already had enough but didn't know it.

The Factors Behind Your 'Retirement Number'

And Why it's Critical to get it right

You Can't Reach a Destination without SETTING ONE

You wouldn’t take a holiday without knowing where you’re going, so why leave your financial future up to chance?

Yet, Most Australians enter retirement without a clear plan, hoping their savings will last. But hope isn’t a strategy.

Key Factors that Shape your Retirement Number

- How much will you need for day-to-day living? Could this change as you get older?

- What about travel, do you have some bucket list travel dreams you want to tick off?

- Will any major expenses disappear at retirement (mortgage, school fees, commuting)?

- Will some expenses start at retirement?

- Do you plan on big capital expenses? (renovating your home, caravan, new car)

- Do you want to help your kids financially?

- Will you still earn some income through semi-retirement, investments, government pensions?

- Will you receive any lump sums (inheritance, downsizing your home)?

- How long do you want your money to last—20, 30 years… forever?

- What portfolio returns do you need to make this all work?

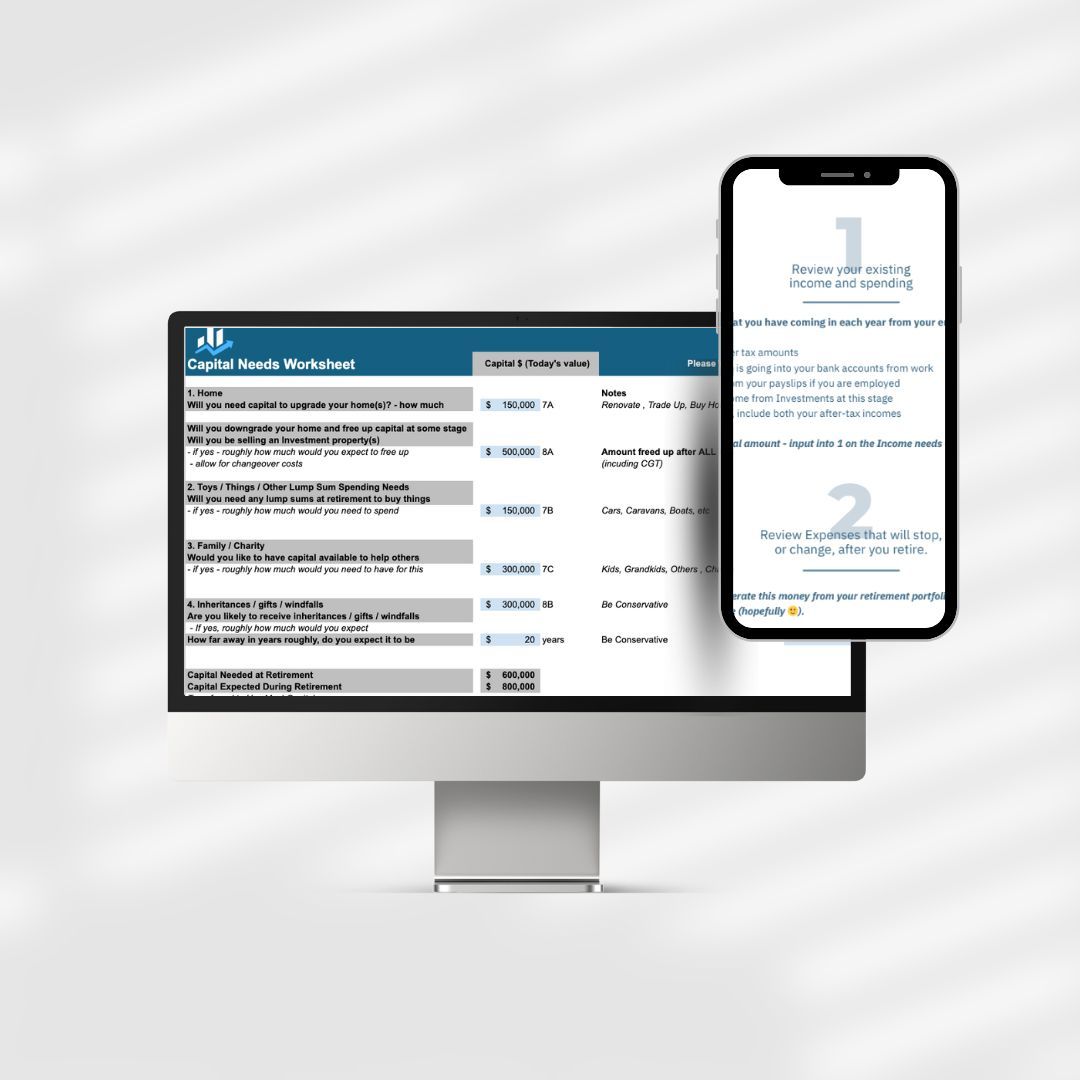

In this Live Workshop, Rob will take you through the above step-by-step using The How Much Calculator

The How Much Calculator is a comprehensive tool that factors in all of the above - Giving you a crystal clear number based on your life.

The Cost of Doing Nothing? Financial Uncertainty.

If you don’t take control of these decisions now, they’ll be made for you later, often when it’s too late to adjust.

Working out How Much You Need is one of the most crucial steps in your retirement plan.

Yes, it may seem overwhelming, but with the right process, it becomes simple and empowering.

The How Much Workshop is designed too give you a clear, step-by-step formula to find your number, so that you can retire with confidence.

The Live How Much Workshop

Created by award-winning financial adviser Rob McGregor, this tool gives you the clarity most Australians never get when planning for retirement.

You'll get access to our interactive How Much Calculator, built to help you:

- Plug in your real numbers.

- Factor in your life variables like income, spending, major expenses and timeframes.

- Factor in retirement lump sums like inheritance, house downsize, house upgrade etc.

- Instantly estimate how much you'll need to retire comfortably.

- Adjust, refine, and optimise your plan as your circumstances evolve.

To guide you through the process, Rob will walk you through everything live, using the calculator and workbook in real time, so you can map out your personalised retirement number step by step. Rob will also be available for a Q&A session answer any of your questions.

After the session, you’ll get access to the full replay plus ongoing access to the calculator and workbook inside our secure member portal, so you can revisit and refine your plan any time.

And because we want this to be a no-risk, high-value experience, we offer a 100% satisfaction guarantee.

REGISTER FOR THE WORKSHOPWho Are We?

Runway to Retirement is an online educational platform designed to help you create and manage your own financial plan using the same tools and strategies top financial planners rely on.

Our founder, Rob McGregor, is one of Australia’s leading financial planners with over 30 years of experience, multiple national awards, and a track record of helping thousands of Australians achieve their financial dreams. Rob is the founder of McGregor Wealth Management and co-founder of GPS Wealth, a national financial advisory group with over 150 advisers.

His mission is simple: make professional-level retirement planning tools accessible to everyone, so you can take control of your financial future with confidence.

ACCESS THE CALCULATOR

What Rob's planning clients are Saying

Our financial goals are on track!

I knew we needed a clear and straightforward plan that focused on our specific goals. Without going through the goal setting process, I think we would have continued with ad hoc investing that reacted to markets, instead of having a very specific plan. Once everything is set up, the process really is set and forget. We have 2 simple goals: to retire “on time” with our goal retirement funds behind us; and to continue investing to support our income goals. Both of them are on track!

Leanne H.

We unreservedly recommend Rob McGregor and his team.

Rob has successfully managed the transition from our working lives to us becoming comfortably retired. During our over a decade long association as clients, Rob and his team presented a thoroughly professional, optimistic and supportive program on behalf of his efforts to represent us.

John and Petra M.

Eliminate Fear & Take Control

We’ve helped thousands of Australians gain absolute clarity on their retirement plan. And here’s the truth: every financial decision about retirement should start with one question, How Much?

In this live, interactive workshop, you’ll work alongside award-winning adviser Rob McGregor as he guides you step-by-step through our proven calculator and workbook.

You’ll finally get crystal clear on your retirement number, no more guessing, no more uncertainty. You’ll also be able to test different scenarios, adjust your assumptions, and see exactly how small decisions can impact your long-term future.

100% Money-Back Guarantee – If you don’t walk away with a clear retirement number and more confidence than you started with, we’ll refund you. No risk, no stress.

What you get

Not Sure if this is for you? Only Register If...

-

You’re not confident how much money you’ll need, or how long it will last

-

You're hoping you can retire in the next 5-10 years

-

You’re unsure if you will be able to afford your dream retirement

-

You keep putting off retirement decisions because it all feels too complex

How Much Workshop - September 1st, 2025 - 6:00PM

$79

✅ Live Workshop event with Rob McGregor

✅ All tools, calculators & workbooks included

✅ Rewatch as many times as you need

✅ Instant access – start planning today!

ALL OF OUR WEBINARS, WORKSHOPS, COURSES, WORKBOOKS AND OTHER MATERIALS CONTAIN GENERAL ADVICE AND FACTUAL INFORMATION ONLY. NOTHING WILL TAKE INTO ACCOUNT YOUR OBJECTIVES, FINANCIAL SITUATION OR NEEDS. BEFORE ACTING ON ANY INFORMATION, YOU SHOULD CONSIDER THE APPROPRIATENESS OF THE INFORMATION HAVING REGARD TO YOUR OBJECTIVES, FINANCIAL SITUATION AND NEEDS.

BEFORE MAKING A DECISION ABOUT A SPECIFIC FINANCIAL PRODUCT, YOU SHOULD CONSIDER THE PRODUCT DISCLOSURE STATEMENT (PDS). WE ALSO RECOMMEND SPEAKING TO A FINANCIAL ADVISER SHOULD YOU NEED ONE.

Me, Robert McGregor (Rob), I am a qualified adviser with over 25 years of experience, an Authorised Representative of GPS Wealth Ltd AFSL 254 544 . My Authorised Representative number is 2450