Congrats, Your Free Resource Is Ready

Step 1: Access the 9-Page Manifesto Here

We have also emailed it to you!

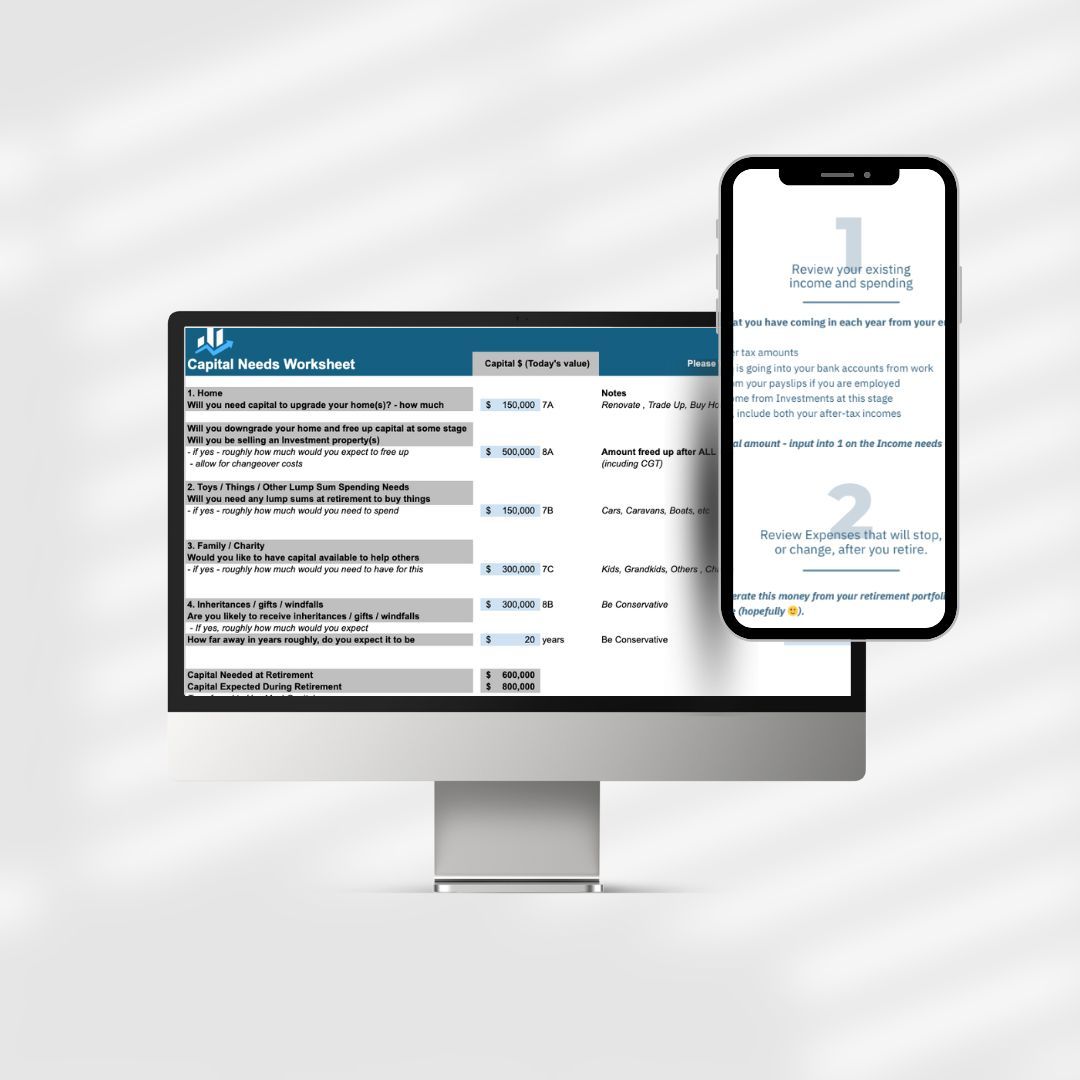

Step 2 Easily Calculate How Much You Need to Retire

This is strictly for Australians who want a simple way to work out exactly how much they’ll need to retire, with all the maths done for you.

Most people have no idea if they can retire comfortably or how much they'll need. This calculator helps you break it down, step by step, based on your life.

Chances are, you haven't considered all the variables that impact how much you need. There are factors most people overlook, and they can have a big impact on your retirement. (Positive and Negative)

CLICK HERE TO CALCULATE

Who Are We?

Runway to Retirement is an online educational platform designed to help you create and manage your own financial plan, using the same tools and strategies top financial planners rely on.

Our founder, Rob McGregor, is one of Australia’s leading financial planners with over 30 years of experience, multiple national awards, and a track record of helping thousands of Australians achieve their financial dreams. Rob is the founder of McGregor Wealth Management and co-founder of GPS Wealth, a national financial advisory group with over 150 advisers.

His mission is simple: make professional-level retirement planning tools accessible to everyone—so you can take control of your financial future with confidence.

CLICK HERE TO CALCULATE